RPA in Financial Services. It is an approach to automate business processes using software “bots”.RPA stands for Robotic Process Automation

RPA enables organizations to generate bots that observe a user’s digital activity. The bots capture and execute applications for processing transactions, manipulate data, trigger responses, and communicate with devices.

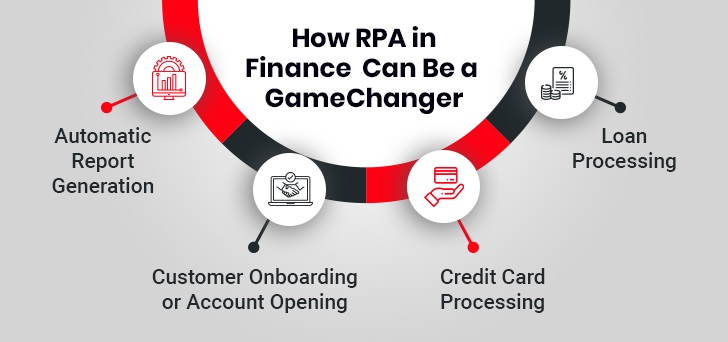

Use Cases of RPA in Financial Services

RPA in Financial Services

The world of Finance is continuously evolving, due to technological advancements. Financial institutions aim to provide improved services at lower costs with enhanced productivity for global clients.

RPA helps organizations achieve all of these objectives. The bots are deployed to mimic and execute daily tasks.

RPA combines robotic automation and Artificial Intelligence to improve financial services. It automates tasks like form filling, data extraction, data formatting, etc.

Benefits of RPA in Financial Services

- Enhanced Efficiency

RPA automates daily tasks for organizations. It allows employees to focus on the strategies and growth of the business.

Hence, operational tasks run faster with improved productivity. RPA helps organizations enhance their processes and their execution.

- Cost-Effective Services

According to a survey by Accenture, RPA is said to reduce costs by up to 80 %. The reasons could be reduced human errors and time efficiency.

Deploying RPA to run day-to-day tasks also prevents companies from hiring new employees. It avoids bearing the costs of training these employees for the processes RPA has already mastered.

- Speed

RPA operates on a 24/7 cycle. It executes several mundane tasks faster than humans.

RPA performs tasks and saves up to 80-90 % time. Considering the time it does not sacrifice efficiency either.

It eliminates potential human errors from equations. It provides greater output with more accurate and predictable results.

- Improved Compliance Reporting

Financial services companies need to comply with multiple industry regulations. RPA helps reduce risk and manages processes to adhere to compliance.

Role of RPA in the Finance Department

The Finance and Accounting department in an organization plan strategies and analyze the scope of the financial year. They provide comprehensive analysis while looking after the day-to-day tasks like billing and monitoring payroll.

The department works and collaborates with other operational departments in an organization. They not only manage current financial scenarios but also help predict future functions.

The Finance Department uses RPA to streamline monotonous and manual processes. It also uses RPA to integrate object-oriented applications and centralize automated business operations.

PayPal

PayPal is an online payment operating systems company. It enables users to transfer money without using traditional physical methods.

PayPal has more than 250 million active users. It is important to protect their sensitive data.

There is a major concern regarding the protection of online transaction data. To prevent incidents PayPal leverages RPA along with AI and machine learning approaches.

RPA helps monitor transactions 24/7. It maintains customer records and encrypts extensive data.

RPA also learns from user’s online patterns and alerts developers regarding improvement and enhancement.

The technology helps identify suspicious activities and separate false alerts from real ones. PayPal invests around $300 million annually for anti-fraud and prevention technologies.

BNY Mellon

Bank of New York Mellon aka BNY Mellon is an investment banking services company. It is one of the largest asset management companies in the world.

In May 2016, the company integrated with RPA for day-to-day job functions. They built a Smart technology ecosystem to complement their global workforce.

RPA has helped the organization with 100 % accurate account closures across five systems. It has improved processing time and trade entry turnaround time.

According to the case study by bestpractice.ai, "BNY Mellon uses robotic process automation software from Blue Prism, which is built on the established and proven Microsoft.NET Framework. It automates any application and supports any platform (mainframe, Windows, WPF, Java, web, etc.) presented in a variety of ways (terminal emulator, thick client, thin client, web browser, Citrix, and web services). And it provides a single capability for automating all of the applications used within an organization. Through the use of distributed Software Robots, Blue Prism is highly scalable and can be provisioned in the cloud or as an on-premise enterprise deployment."

Blue Prism

Blue Prism is a multinational software corporation from the UK. It develops intelligent RPA solutions for organizations.

Its solutions have helped financial institutions through process automation, enhance productivity and reduced costs. The solutions operate 24/7 and provide a 100% audit trail for the work.

Blue Prism’s RPA solutions help organizations leverage humans and digital networks. It analyzes, builds, and innovates relationships with customers.

Financial and auditing companies like Ernst & Young, Mashreq Bank, BNY Mellon, etc. utilize the solutions to meet compliance regulations, optimize or manage data and even enhance day-to-day efficiencies. Blue Prism’s RPA aims to build a new breed of technologies and deliver processes strategically.

Sandeep Chouhan, Group Head, Operations and Technology at Mashreq Bank states, “At Mashreq close to 97% of our financial transactions are originated and processed digitally, almost 80% of our non-financial transactions are run by a robotic process.”

Blue Prism’s Connected RPA solves challenges in regulation & compliance. It improves customer experience, reduces financial crime, and automates business operations.

USAA

USAA is a Fortune 500 banking, insurance, and investment services company. It serves millions of military members and their families at competitive rates.

Currently, USAA is located in 5 states namely, Texas, Florida, Arizona, Virginia, and Colorado with multiple city locations. Each state and city has a set of regulations for financial companies.

RPA plays an important role to help USAA enhance their customers’ experience. The RPA solution leverages AI to interact with customers using virtual agents.

USAA refers to this as “digital empathy” where customers interact with bots trained for repetitive scenarios. In case if the customer wishes for a live agent the bots are trained to connect them as well.

WorkFusion

WorkFusion is a leading provider that combines AI, RPA, and machine learning to provide solutions. Its major global clients include Deutsche Bank, Standard Bank, Axis Bank Carter Bank & Trust, etc.

Standard Bank, Africa’s largest bank cuts up to 60% of verification time. WorkFusion’s RPA solution helps automate up to 1 million transactions in a month.

Axis Bank is India’s third-largest private sector bank. It automates the KYC process, reduces errors up to 70% with a 30 % decline in labor costs.

Deutsche Bank uses WorkFusion’s RPA to automate compliance screening operations. It helps the bank reduce significant costs by streamlining processes including customer service, revenue growth, examining data, etc."We picked WorkFusion because they provide a learning automation platform, which means our employees did not have to become programmers to use it." states Mark Matthews, Head of Operations at Deutsche Bank.

Conclusion:

According to Gartner, “By 2024, organizations will lower operational costs by 30% by combining hyper-automation technologies with redesigned operational processes.”

RPA is a pivotal asset in Financial Services and will automate day-to-day operations.

You May Also Like to Read: